Inflation Nation

The United States reports the highest inflation rate in 40 years.

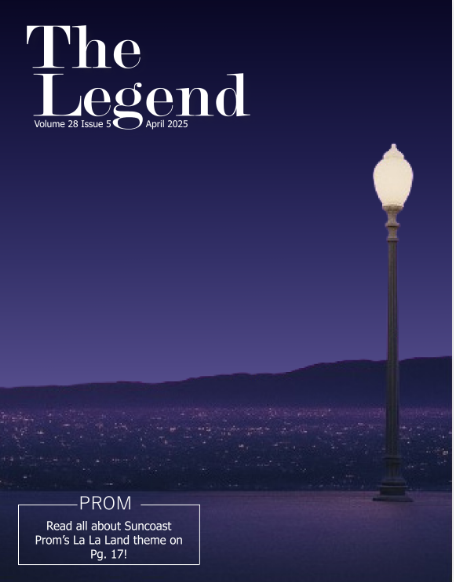

When gas prices soar, the cost of products will rise with it.

April 15, 2022

Dollar Tree, the country’s last true dollar store, announced they will stop being a dollar store. As of May 2022, Dollar Tree will raise the prices for all items in most of their stores to $1.25, putting an end to a market with over 80 years of history. The main reason for the price change? Inflation.

On March 10, 2022, the United States registered the highest inflation rate in over 40 years. The Consumer Price Index released by the U.S. Bureau of Labor Statistics showed the inflation rate for all items rose a staggering 7.9 percent compared to last year. The rate is even higher for certain categories. For instance, the fuel oil prices rose by 43.5 percent compared to last year. While this is not the Venezuelan 2,000,000 percent inflation rate from 2018, it is a concerning rate that surpasses even the rate from the 2008 financial crisis.

Inflation happens when there is too much demand and not enough supply. This peak in inflation came shortly after the largest surge of COVID-19 cases.

“Inflation isn’t always bad news. A little bit is actually quite healthy for an economy,” University of South Carolina professor William Hauk said. The average inflation rate for the last decade was 2.2 percent, which indicates a steady, healthy economic growth. But, the problem comes when the inflation rate rises higher than what is desired.

“If prices are falling, companies may be hesitant to invest in new plants and equipment. And inflation can make it easier for some households with higher wages to pay off debts,” Hauk said. Many economists, however, suggest that an inflation rate above 5 percent will be detrimental to the economy. The main reason is that wages do not tend to increase accordingly with inflation. According to the U.S. Department of Labor, wages in 2021 increased an average of 4.7 percent, which is 3.2 percent lower than the 7.9 percent inflation rate reported in February. This means that the average American has 3.2 percent less money to spend in 2021 than they did in 2020, and when people have less money to spend, they tend to buy less.

“If your dollar doesn’t go as far, you’re not able to buy as much,” Suncoast AP Government and Economic Financial Literacy teacher Neil Brown said. The average consumer has less purchase power due to products costing more than what they budget for. This change also extrapolates to businesses, which lowers production.

“Businesses see the prices of key inputs, like oil or microchips, rise, and as a result, they may have to cut back production, increasing supply chain problems,” Hauk said.

The most simple way to decrease inflation is to raise interest rates. When interest rates are higher, the economy tends to slow down due to demand decreasing, which leads to inflation decreasing in turn. However, if interest rates rise too quickly it may lead to economic stagnation, and in extreme cases, a recession.

“If the [Federal Reserve Bank] is forced to raise interest rates too quickly, it can even cause a recession and result in higher unemployment,” Hauk said. Striking the perfect balance between interest rates high enough to slow down inflation and low enough to not cause a recession, while doing it slow enough to give time to the consumers to adapt to the higher interest rates, is a very delicate effort, but also a highly important one.

“We’re still in a very favorable lending market. In the next few months we might see a drastic shift in that,” Brown said. Due to the war between Russia and Ukraine and the subsequent sanctions on Russian trade, it is expected that gas prices will go up even higher, something that is happening already. Gas prices are one of the main indications on the state of inflation.

“Gas prices go up, all things will go up. Everything you buy will be affected,” Brown said. A war that is happening across the world has such a significant effect in the American economy due to the world’s economy being so globalized. Russia is a major oil supplier of both Europe and the United States, encompassing 7 percent of all oil imports into the U.S. according to the Energy Information Administration.

“The world is super inter-connected, so what happens across the world really does affect what happens in your house,” Brown said. This also means that the United States is not the only country that currently faces such high inflation rates. Due to the global economy recovering from the effects of COVID-19, including the largest surge in cases through the second half of 2021, almost all currencies in the world suffered from higher inflation rates than usual.

“The global economy in itself is facing inflation, just because of everything that’s going on,” Brown said. If dealt with correctly, inflation should not be a problem for too long. However, the uncertainty of today’s global stage leaves no definite path for the American economy. If previous economic recessions are something to go by, the economy will recover and come back stronger. Until that happens, though, inflation will be a part of the daily lives of all Americans.